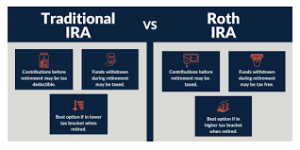

Saving for retirement is one of the most critical financial goals you’ll ever undertake. Whether you’re just starting your career, in your mid-life, or approaching retirement, it’s essential to have a plan that ensures financial security during your golden years. The key to successful retirement planning is understanding that the approach you take should evolve […]