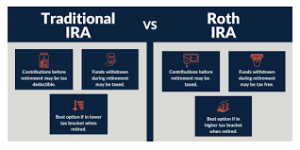

Taxes are an inevitable part of life, but there are legal strategies available to minimize your tax burden. By taking advantage of various deductions, credits, and investment opportunities, individuals and businesses can significantly reduce their tax liabilities. In this comprehensive guide, we will explore a variety of effective and legitimate ways to lower your taxes, […]