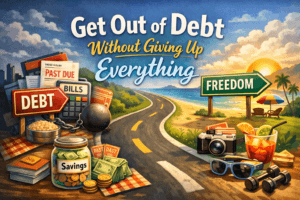

Ever feel like every debt advice article is basically yelling, “Sell everything. Stop living. Eat rice and beans forever”? Yeah… no thanks. Trying to wipe out debt by going full financial monk might work for a few months—but for most people, it backfires spectacularly. Think of debt payoff like training for a marathon. Sprint too […]